EU Own Resources System

Own Resources System

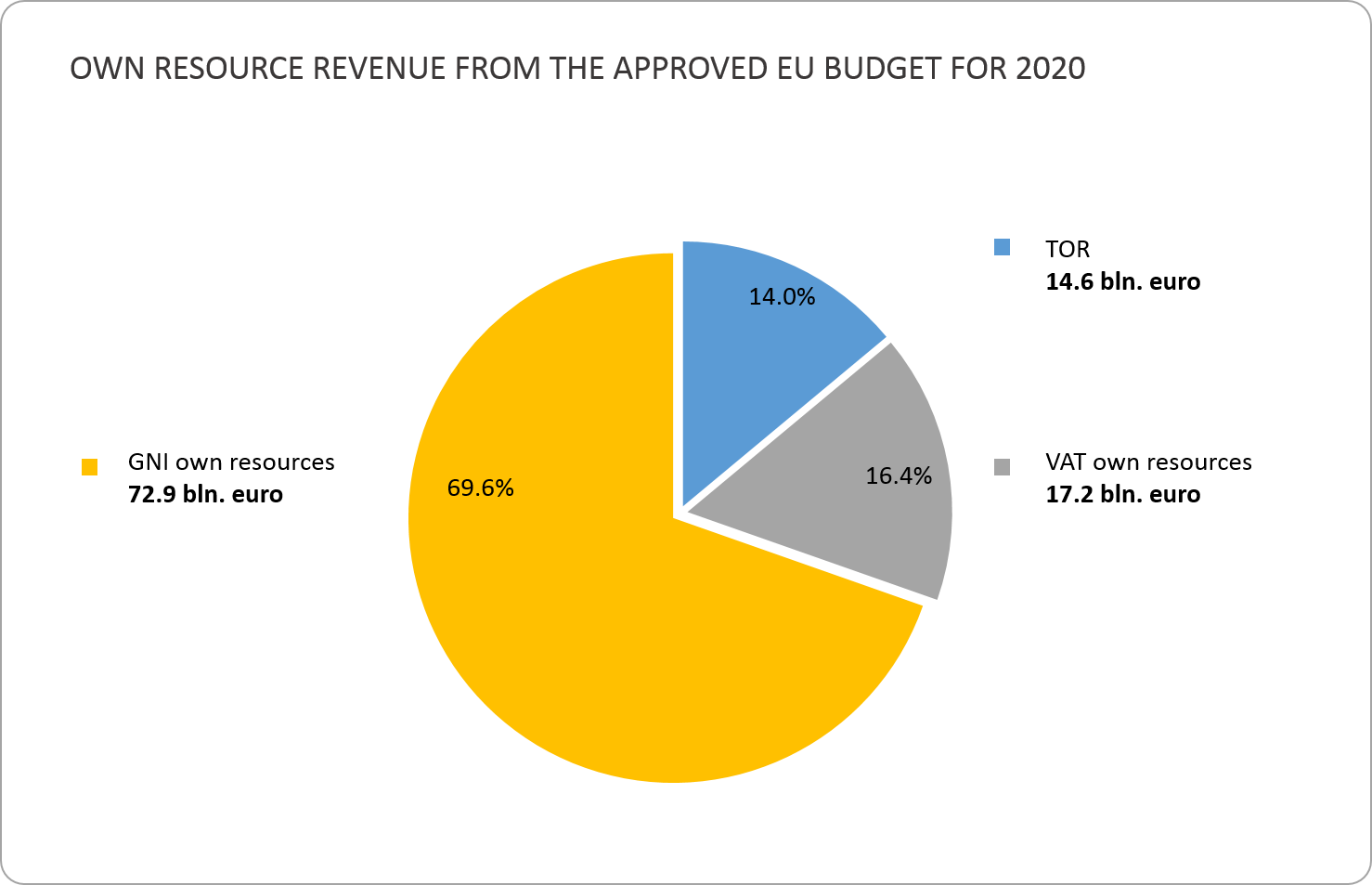

The system of EU own resources has been significantly amended over the years - from funding solely through contributions from Member States to financed wholly from own sources (initially only with traditional own resources (TOR), and later TOR and a VAT based resource) and to the current system, which combines revenues from TOR with national contributions from Member States comprised from a VAT based resource and the complementary resource based on the GNI. There are several adjustments - a mechanism for correcting the budgetary imbalance of the United Kingdom (the so-called “the UK rebate”) and gross reductions for Austria, Denmark, the Netherlands and Sweden.

Traditional Own Resources – the EU traditional own resources (TOR), i.e. mainly customs duties, are defined in Article 2(1) (a) of the Own Resources Decision currently in force (ORD 2014). The Member States are responsible for the collection of these resources as provided for in Article 8 of that Decision and they establish, account for, recover and make available the TOR to the Commission in accordance with the more detailed rules laid down in the Council Regulation (EU, Euratom) No 609/2014. In addition, Member States must have adequate controls infrastructure to ensure that their administrations (especially customs) carry out their tasks in an appropriate manner. The Member States retain 20%, by way of collection costs, of TOR paid to the Commission.

Value added tax-based own resource – this own resource is defined by applying a uniform call rate (0.30% for all Member States except Germany, the Netherlands and Sweden that benefit from a reduced call rate of 0.15%) to the harmonised value added tax (VAT) base of each EU Member State.

Gross National Income-based own resource – this resource is a „balancing” resource that provides the revenue required to cover expenditure in excess of the amount financed by the traditional own resources, VAT-based contributions and other revenue in any year. The GNI-based resource ensures that the general budget of the Union is always initially balanced. Currently, the total amount of the own resources allocated to the Union to cover annual appropriations for payments cannot exceed 1.20 % of the EU GNI.

the UK rebate – the UK is reimbursed by 66% of the difference between its contribution to the Eu budget and what it receives back from the budget. The cost of the UK rebate is divided among all Member States in proportion to their share to the EU GNI. Since 2002 the normal financing share for Germany, the Netherlands, Austria and Sweden has been limited to 25%.

Gross reductions for Austria, Denmark, the Netherlands and Sweden - for the period 2014-2020 only these Member States benefit from gross reductions as follows: EUR 695 million for the Netherlands, EUR 185 million for Sweden and EUR 130 million for Denmark (in constant 2011 prices). Austria benefit from a phased-out lump sum of EUR 30, 20 and 10 million for 2014, 2015 and 2016 respectively. These corrections are granted only after the calculation of the UK rebate and its financing. The gross reductions are financed by all Member States.